Financial Freedom: Easy Steps to Save Money and Grow Wealth.

In an increasingly complex financial landscape, understanding how to manage your money is essential for achieving financial stability and growth. This guide provides practical steps, templates, and tools to help you save effectively and grow your wealth through financial discipline.

Understanding Financial Literacy.

Financial literacy involves knowing how to manage your finances, including budgeting, saving, investing, and understanding credit. Here’s how to get started:

Step 1: Create a Budget.

A budget is a crucial tool for tracking your income and expenses. Here’s a simple budget template to help you get started:

Instructions:

- Fill in your estimated income and expenses at the beginning of the month.

- Track your actual income and expenses throughout the month.

- Calculate the difference to see where you stand.

Step 2: Build an Emergency Fund.

One of the first steps in financial literacy is establishing an emergency fund. This fund should ideally cover three to six months’ worth of living expenses. It acts as a financial safety net, providing peace of mind and preventing the need to rely on credit cards or loans in times of crisis. Here’s a simple savings tracker:

Instructions:

- Set a monthly savings goal for your emergency fund.

- Track your savings each month to see your progress.

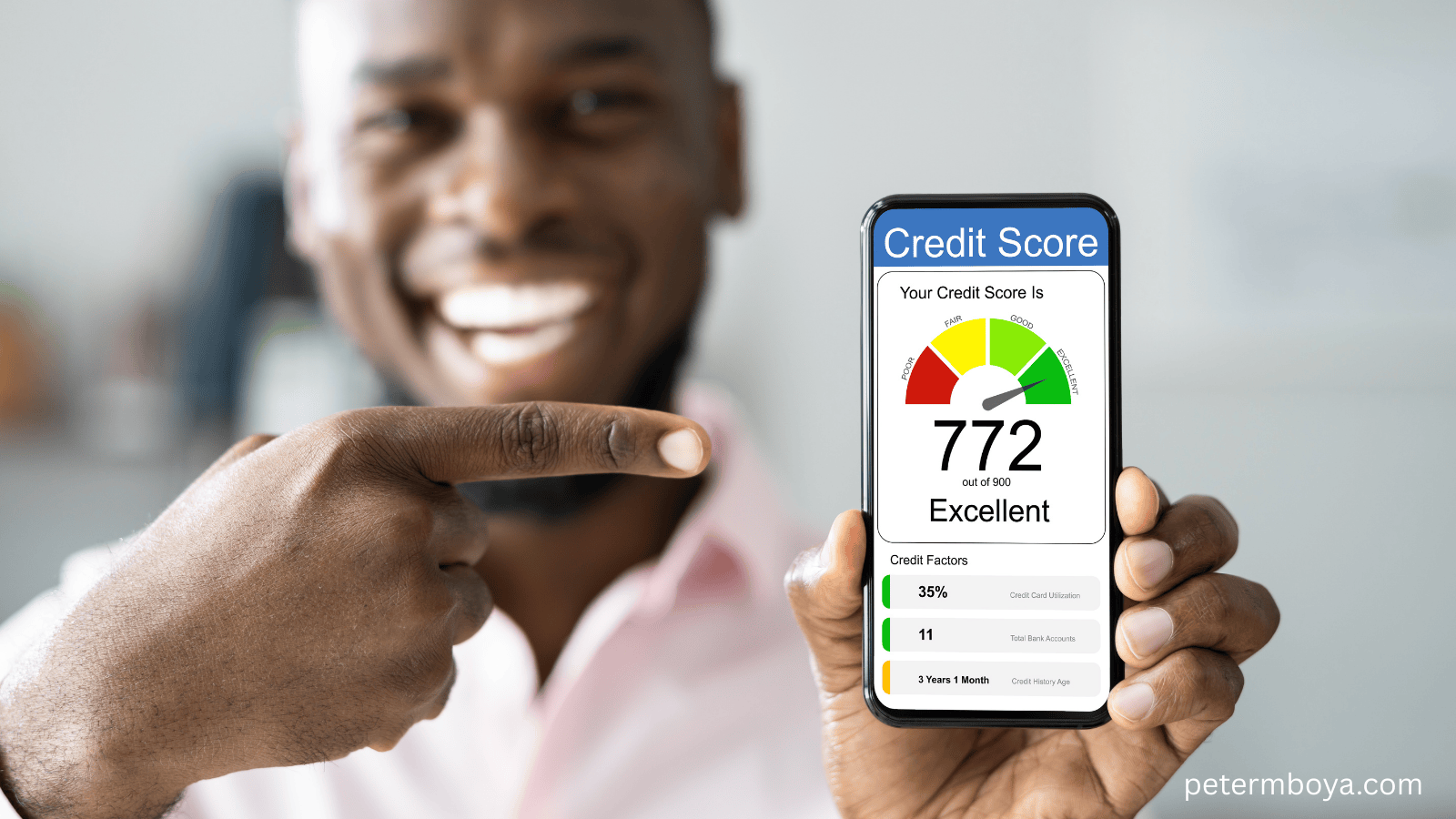

Step 3: Monitor Your Credit.

Your credit score plays a significant role in your financial health. Regularly check your credit report for errors and work on improving your score by paying bills on time and reducing debt.

Below is a snowball debt tracker.

Step 4: Set Financial Goals.

Establish both short-term and long-term financial goals. Whether it’s saving for a home, funding your children’s education, or planning for retirement, having clear objectives will guide your financial decisions.

Below is a financial goal savings template:

Instructions:

- Define specific, measurable, achievable, relevant, and time-bound (SMART) goals.

- Break down each goal into actionable steps.

Step 5: Cultivate Financial Discipline.

Financial discipline is key to achieving your goals. Here are some practical tips:

- Stay Committed: Regularly review your budget and savings goals.

- Avoid Impulse Purchases: Implement a 24-hour rule for non-essential purchases.

- Review and Adjust: Revisit your budget and goals quarterly to make necessary adjustments.

- Seek Professional Advice: Consult a financial advisor for personalized guidance.

Conclusion.

Financial literacy and education are vital components of achieving financial stability and growth. By understanding the principles of saving, investing, and maintaining financial discipline, you can take control of your financial future. Start today by setting clear goals, creating a budget, and committing to a disciplined approach to managing your money. With time and effort, you can build a secure and prosperous financial life.